Address

304 North Cardinal

St. Dorchester Center, MA 02124

Work Hours

Monday to Friday: 7AM - 7PM

Weekend: 10AM - 5PM

Address

304 North Cardinal

St. Dorchester Center, MA 02124

Work Hours

Monday to Friday: 7AM - 7PM

Weekend: 10AM - 5PM

In January and February 2023, Vietnam’s export of timber and wooden products decreased by 34.8%. According to data from the Vietnamese Ministry of Industry and Trade, the export value of timber and wooden products in Vietnam in January and February was $1.6 billion, a 34.8% decrease compared to the previous year. In 2020, Vietnam replaced China as the largest furniture exporter of the United States. By the end of 2021, although the gap was small, China had regained the top spot. These two countries are now in close competition.

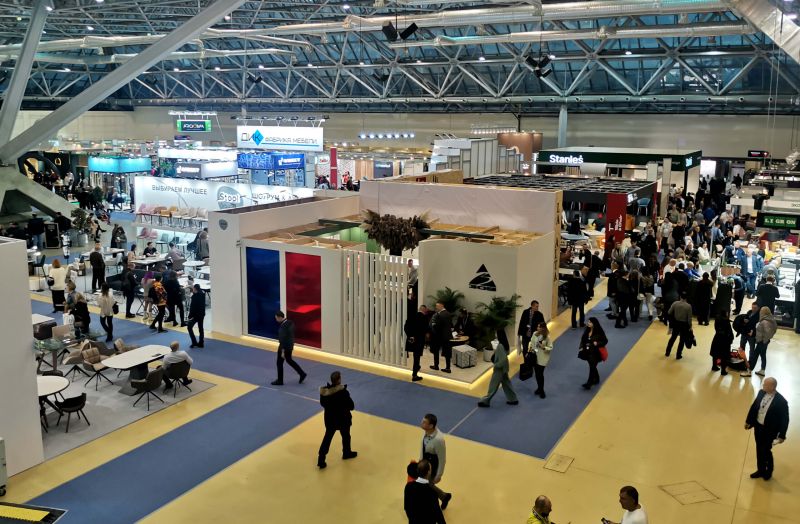

In March 2022, the Vietnamese government announced a goal of exporting $20 billion worth of timber and wooden products annually by 2025. The plan details how Vietnam will significantly expand and upgrade its timber processing industry by 2023. Some of these include substantial technology investments, building international furniture exhibition centers, and restructuring its production areas.

The decline in real estate transactions in the United States has also had an impact on China’s furniture exports, with exports to the US declining by nearly 20% in the first two months of this year. Furniture exports fell by 10.1% year-on-year in the first two months. On March 7, 2023, the General Administration of Customs released the import and export situation from January to February 2023. Among them, the export value of furniture and its parts from January to February was 64.08 billion yuan, a year-on-year decrease of 10.1%; the export value of ceramic products was 26.82 billion yuan, a year-on-year decrease of 7.1%; the export value of lamps, lighting devices, and their parts was 41.91 billion yuan, a year-on-year decrease of 9.8%.

At the beginning of 2023, there are still many uncertain factors in the international environment, and the global trade situation remains severe and complex, with slowed external demand growth and decreased orders, and downward pressure on the industry still exists. However, judging from the recent situation of “going out to grab orders,” overseas demand has rebounded in late February and is expected to continue the good momentum.

According to data provided by Estacom, from January to December 2022, Spain’s furniture exports increased by 13%, totaling more than 2.954 billion euros. Although the market is currently experiencing difficulties, Spain’s annual growth is significant, with exports exceeding levels from the years before the outbreak of the COVID-19 pandemic. France accounts for 28.4% of Spain’s furniture export total and has grown by 5.2% compared to the previous year, maintaining its leading position. Portugal is the second-largest buyer of Spanish furniture, with a growth of 19.6%, exceeding 436.8 million euros. The United States import of Spanish furniture increased by 17%, ranking third in the global destination ranking of Spanish furniture at the end of 2022. Italy also entered the top ten, and exports to the United Kingdom, Morocco, the Netherlands, Mexico, and Belgium all increased significantly.

According to a report by Reuters on January 21st, last December, the sales of existing homes in the United States were calculated as 4.02 million units when signed, down 1.5% year-on-year and the lowest level since November 2010. At the same time, home resales, which account for a large part of U.S. home sales, fell 34.0% year-on-year in December, and for the whole of 2022, they fell 17.8% to 5.03 million units, the lowest annual total since 2014 and the largest annual decline since 2008.

The volume of U.S. housing transactions has plummeted, and manufacturing data has also been volatile. Recently, the Institute for Supply Management (ISM) released its latest manufacturing data. In February of this year, the U.S. manufacturing Purchasing Managers’ Index (PMI) was 47.7%, up only 0.3 percentage points from January’s 47.4%. ISM said that after 28 months of growth, manufacturing economic activity shrank for the fourth consecutive month in February. In the past two months, the manufacturing PMI has been at its lowest level since May 2020.

In ISM’s survey of manufacturing sub-industries, the U.S. furniture industry had declining new orders, imports, and output in February. Subsequently, China’s exports of furniture to the United States also declined. According to data from the General Administration of Customs, China’s total exports of furniture products to the United States in January-February this year were 30.42 billion yuan, down 19.32% year-on-year from 37.705 billion yuan in the same period last year.

As an important market for Chinese furniture exports, the United States has always been regarded as a “cash cow” by many furniture export companies. Products can be sold at a premium in high-income areas, resulting in higher profits. In past years, the market share in the United States has fluctuated around 30%. At the same time, China has also been the top importer of furniture in the U.S. for many years. However, in the trade friction in 2019, tariffs were imposed on a variety of home products, including original furniture and wooden furniture, which also affected China’s furniture exports.

According to data from Furniture Today, China’s exports of furniture to the U.S. showed a significant decline that year, dropping from $13.5 billion to less than $10 billion, and falling to $7.3 billion in 2020, allowing Vietnam to surpass China for first time with a difference of less than $100 million, becoming the largest importer of furniture in the U.S. It is worth noting that in 2021, China has become the largest country for furniture imports into the United States again. That year, it exported $9.117 billion of furniture to the U.S., while Vietnam came in second with $9.1 billion.

During the three years of the epidemic, 2020 and 2021 were major turning points for domestic furniture exports. At that time, other countries in the home industry chain were in the midst of an epidemic outbreak, and the domestic furniture export industry grew rapidly due to the poor environment, which also gave rise to cross-border e-commerce.

A considerable part of domestic cross-border e-commerce is also concentrated in the home furnishing industry, such as small furniture, indoor and outdoor decorations, gardening tools, etc. At that time, cross-border e-commerce became a hot segment. Lelecha (300729. SZ), a stock once favored by the capital market, is a typical cross-border e-commerce enterprise specializing in office chairs.

Cheng Guilang, the founder of Ami Cross-border, told Jiemian Home that there are three main reasons for the above data changes. First, US importers panicked and overstocked in 2021, but by the end of 2022, they found that the supply chain in China and other countries was not as bad as they had imagined, so they cleared inventory in large quantities. Second, the demand for furniture replacement decreased after the cancellation of a home office. Third, consumers’ purchasing power is decreasing, “so the contraction of the US furniture market is normal.”

Wang Zhenze, deputy director of the Regional Development Planning Department of China (Shenzhen) Comprehensive Development Research Institute, believes that it is not the industry that is contracting, but the consumer demand that is decreasing, and consumer confidence is also declining.

According to data released by The Conference Board, a global enterprise association, on February 28, US consumer confidence fell again in February. Its Chief Economist, Ataman Ozyildirim, also stated that consumers may show early signs of reducing spending in the face of high prices and rising interest rates and that consumers planning to buy homes or cars are decreasing, and they also seem to be reducing plans to buy major appliances.

Cheng Guilang revealed to Jiemian Home that the contraction of the US furniture market has the greatest impact on home office products, “like Leggett & Platt, which started off buying ships and building their own overseas warehouses, but over the past year, they have put more energy into providing services and incubating new projects.”

In addition, there are also insiders who revealed that the outdoor furniture category has not decreased but increased. At the recent Guangzhou Building Decoration Fair outdoor exhibition, many exhibitors came from Europe and North America. Mindo, a middle-to-high-end brand from Jiaxing, Zhejiang, plans to participate in the Milan Exhibition in April, and it’s US management personnel said they cannot reveal the market conditions in the US.

It is worth noting that in recent years, many domestic enterprises have also sought to transfer their industrial chains. As the ASEAN region has lower tariffs on products exported to the US, coupled with lower local labor costs, Vietnam has become the preferred location for many companies.

Gu Jia Home (603816. SH), a leading soft furnishing company, announced last year that it had completed the construction of a 775,000-square-foot (about 72,000 square meters) restaurant and specialty furniture factory in Vietnam.

Wang Zhenze commented that many companies that have established factories and businesses in ASEAN countries have also incurred many hidden costs. “The local business environment needs to be considered, and the average labor productivity in ASEAN countries is not necessarily higher than that in China. Although the salary level is relatively low, the effective labor capacity is still weaker than that in China. Many companies may withdraw back to China after operating for a few years.”

However, overall, Wang Zhenze believes that home furnishing companies still need to go abroad and further expand their international market, hoping that the labor-intensive furniture industry will see more technological innovation and enhanced R&D capabilities.